This is when you compare your net income to your monthly expenses to see where you stand.

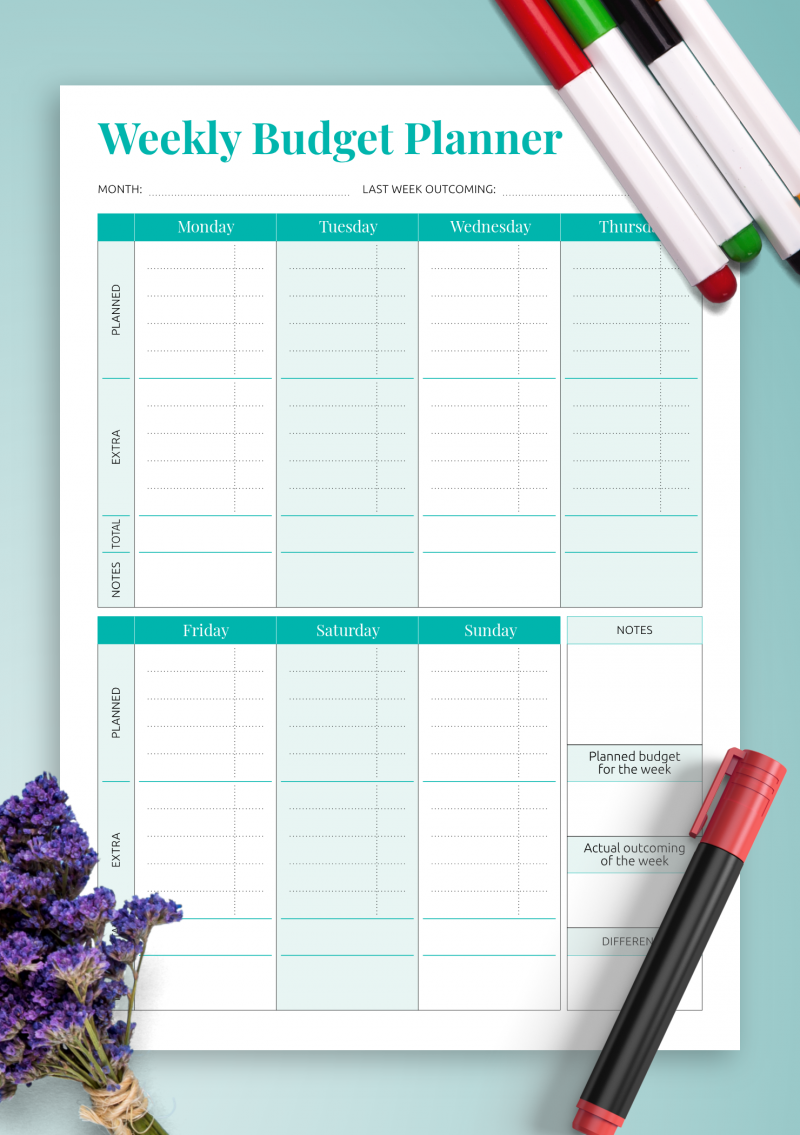

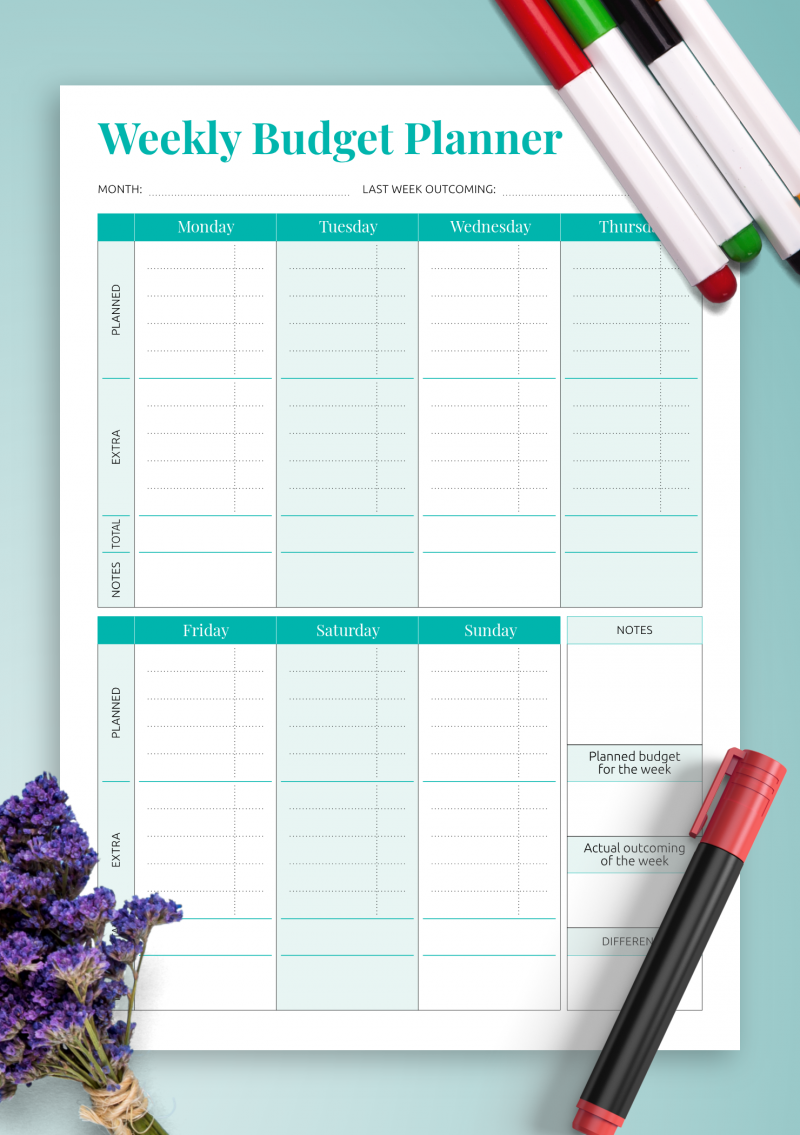

Make adjustments depending on what your budget reveals: The final step in creating a budget is the most telling. It's easiest to do this step while looking at your bank account and credit card statements from the past month. Determine the average monthly costs for each expense: List how much you spend on each expense per month and add them all up. This is an important step in the process because it helps you see where you can cut back if you need to.

Your dining, travel, clothing (beyond the basics), subscriptions and memberships are variable costs. Examples of fixed costs are rent, utility bills, transportation, insurance, food and loan payments.

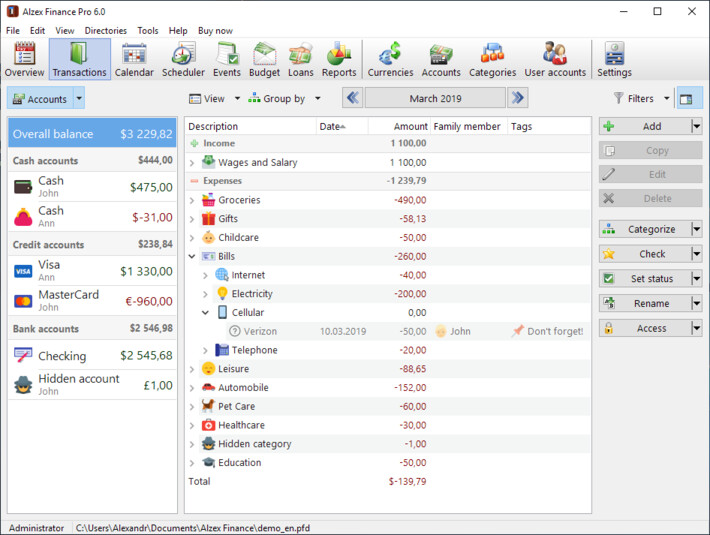

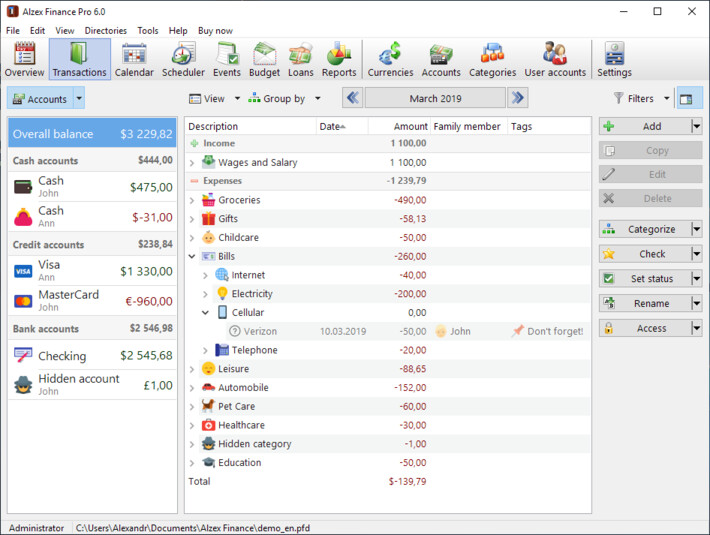

Label the monthly expenses as fixed or variable: Go through your list of monthly expenses and now label each as a fixed (essential items) or variable cost (nonessential items). Also include in this category your savings contributions, such as in a 401(k) or high-yield savings account. Common monthly expenses include rent or mortgage payments, utility bills, loan payments, insurance costs, transportation, child care, groceries, dining, household goods, travel, streaming subscriptions and memberships. List your monthly expenses: Next, you want to look at your monthly costs (your cash outflow). Your net income is the amount of money you earn after taxes and can be found on the pay stub you receive through your employer. Calculate your net income: First, find out how much money you make each month (your cash inflow). Making a budget can be done in as little as five steps: Security features include 256-bit bank grade encryption in a secure data center. App plans to launch a pandemic-inspired feature allowing people to prioritize “envelopes” based on their most urgent expenses, such as housing, utility bills, etc. App offers educational resources like a blog, a podcast and online courses people can take.

App provides real-time updates of how your transactions impact your budget and personalized reports.Requiring manual entry of data helps users to really analyze their spending habits versus it being automated (users can also download their recent activity from their bank’s website and import that into Goodbudget).Users can customize the envelope categories according to their needs, such as saving for an emergency fund or a vacation.Envelope feature allows user to visualize their spending and prioritize meeting different goals.Free to use for creating 20 envelopes, one account user on up to two devices, one year of transaction history, debt tracking and community support.

0 kommentar(er)

0 kommentar(er)